1. The Technological Revolution of Automatic Die Cutting Machine: From “Man-Powered Cutting Lines” to “Photolithography Precision”

In the late 20th century, die-cutting workshops required workers to manually feed paper, visually position it, and press the platen. This was not only inefficient (daily production capacity was less than 5,000 sheets), but also relied heavily on experience for accuracy, resulting in a high scrap rate of 8%-10%. Although the rotary flatbed die-cutter was simple in structure, the manual operation of sheet feeding, collection, and waste removal resulted in high labor intensity and significant safety hazards, with frequent arm injuries.

Automation Breakthrough:

Pneumatic Locking Revolution: After 2010, fully automatic rotary flatbed die-cutter machines introduced vacuum suction technology. Using a suction nozzle to lock the material position, the front and side gauges achieve ±0.1mm positioning, completely eliminating manual paper placement errors.

Automated Waste Removal: The paper collection mechanism integrates a pneumatic impact-driven waste removal bar, which automatically removes scrap within 30 seconds, five times faster than manual waste removal.

Laser Cutting Enters the Market: After 2020, companies such as Han’s Laser and Changrong launched laser die-cutting machines. Their contactless cutting capabilities have boosted precision to ±0.05mm, making them suitable for ultra-thin materials such as flexible circuit boards.

2. Global Market Outlook 2025: Made in China Enters the International Market

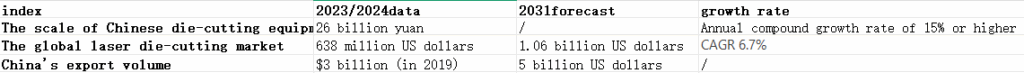

Data Insights: Exploding Increasing Markets

Competitive Landscape: A Technological Confrontation Between Chinese and Foreign Companies

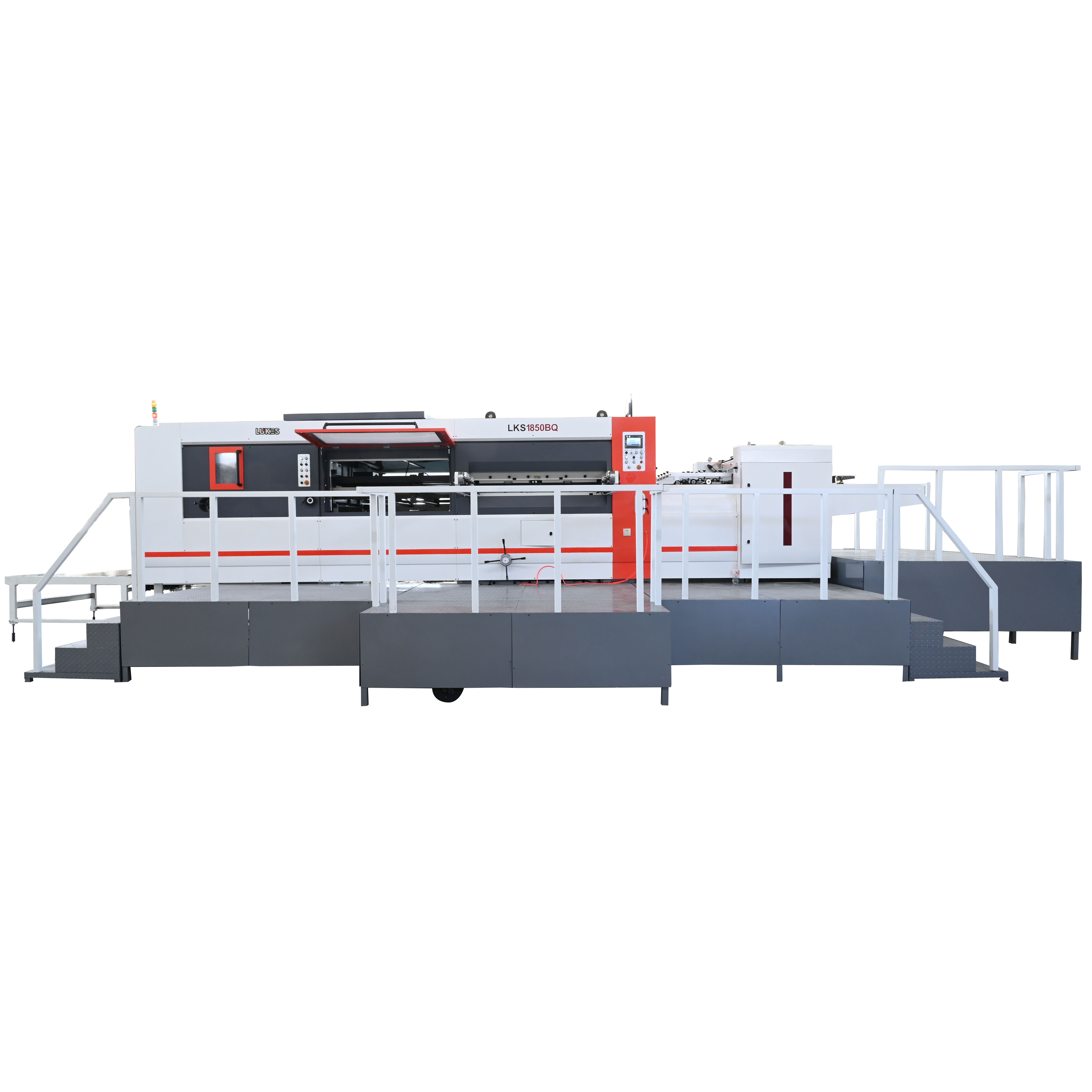

Loosening of the High-End Monopoly: European and American companies (BOBST, Intec) have long dominated the ultra-high-speed (≥150m/min) equipment market, but Chinese manufacturers are breaking through with cost-effectiveness and customization. For example, the Changrong MK1700CS large-format die-cutter (1700×1260mm format) has been deployed in the Mexican factory, offering comparable efficiency at a 30% lower price.

A powerful tool for small and medium-sized enterprises: Semi-automatic models, priced at only one-third of fully automatic models (approximately 130,000 RMB), have seen significant growth in Southeast Asian, Indian, and Pakistani markets.

3. Product Strength Analysis: The Strengths and Weaknesses of Automatic Die Cutting Machine

Core Advantage: A Generational Leap in Efficiency and Precision

Intelligent Integration: The Guangdong Yuexin K7 model features a “scan-to-change order” system, enabling order switching within 30 seconds; servo pressure-free paper feeding technology reduces paper loss to 0.5%.

Format Breakthrough: The Changrong MK1700CS supports 8.5mm thick corrugated paper, suitable for large-format orders such as e-commerce boxes and home appliance boxes, and boasts a 125% improvement in platemaking efficiency compared to traditional machines.

Energy Optimization: Laser die-cutter machines eliminate die wear, saving over 200,000 RMB in consumables costs annually (based on a daily production of 50,000 pieces).

Existing Shortcomings: The Cost-Material Competitiveness

High Initial Investment: Fully automatic laser cutting machines cost over 2 million yuan, with a payback period of approximately three years (a burden for small and medium-sized manufacturers).

Limited Material Adaptability: Laser cutting can easily produce toxic gases when cutting chlorine-containing materials like PVC, so die-cutting machines remain the mainstream choice.

High Maintenance: The intelligent control system requires professional technicians to debug, and after-sales response time in South America and Southeast Asia is 48 hours or longer.

IV. Target Customer Profile: Who is rushing to buy “automatic die-cutting machine and banknote printing machines”?

Large-Scale Packaging Giants:

For example, the Mexican Paper Group (a Changrong customer) focuses on ultra-large format and integrated waste removal equipment, with a daily production capacity requirement of 80,000 sheets or more.

Pain Points: Labor costs account for 18% of revenue, while automated equipment can reduce this to 7%.

Co-printing Service Providers:

Typical Use Cases: Small and medium-volume orders such as A3 magazine covers and beer baskets. The MK1300CS-A model reduces order changeover time to 30 seconds, making it suitable for flexible production runs of 50-500 sheets.

Precision electronics/medical manufacturers:

Lithium battery separators and surgical films require ±0.1mm cutting accuracy, making laser die-cutting machines essential, but also requiring a cleanroom environment.

V. Future Battlefield: Intelligence and the Green Revolution Determine Victory

AI Predictive Maintenance: Sensors monitor die temperature and vibration data in real time, reducing downtime by 60%.

Environmental Compliance Upgrade: The EU will mandate new volatile organic compound (VOC) emission standards in 2027, making water-based cutting fluids a natural replacement for oil-based fluids.

Distributed Manufacturing: A cloud platform connects global equipment. After an Indian customer places an order, the Chinese factory remotely commissions the machine in the Mexican plant and puts it into production. Guangdong Yuexin has already implemented this model for its Indian orders.

Conclusion: Strategic Positioning Under the Dividends of Globalization

The automatic die-cutting machine market has entered a period of technological redundancy. A tiered approach is being adopted to meet global demand, with European and American precision machines, Chinese intelligent manufacturing, and semi-automatic, cost-effective models catering to global needs. Recommendations for companies expanding overseas:

✅ High-end market: Focus on laser cutting and AIoT operations (with a 30%+ premium).

✅ Emerging markets: Promote semi-automatic models and localized services (e.g., establishing repair centers in Vietnam and Thailand).

✅ Differentiation barriers: Develop composite material cutting processes (e.g., carbon fiber + paper-based hybrids) to break out of the competitive landscape.